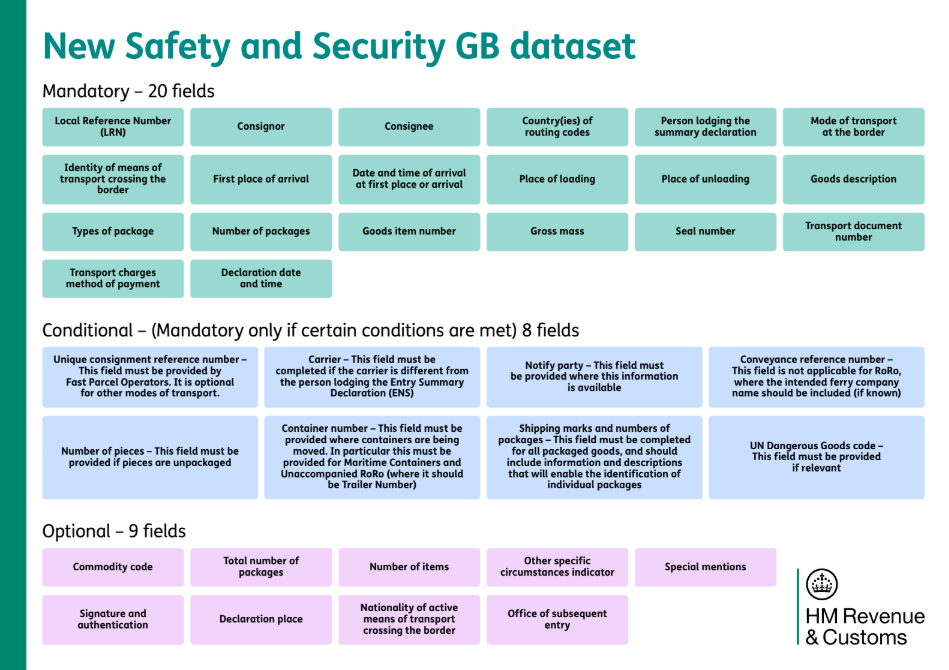

What are the mandatory, conditional and optional S&S GB fields?

HMRC defines which GB ENS fields are mandatory, conditional, or optional. This guide breaks down each one with explanations and XML tags.

HMRC has confirmed what the mandatory, conditional and optional fields are for GB ENS declarations. Let's look at them in more detail!

S&S GB Dataset

Mandatory Fields

- Local Reference Number (LRN) – The Local Reference Number needs to be unique for every submission. This number will be used by HMG to reference the specific entry summary declaration if there are any queries around the submitted declaration before it has been accepted and a movement reference number (MRN) issued.

- In the XML file: RefNumHEA4

- Consignor – Exporter/seller details. HMRC needs these consignor details: EORI number (optional), name, street and number, postcode, city and country code

- In the XML file: TRACONCO1

- Person lodging the summary declaration - The GB EORI number of the person lodging the entry summary declaration must be provided.

- In the XML file: PERLODSUMDEC

- Consignee – Importer/buyer details. HMRC needs these consignee details: EORI number (optional), name, street and number, postcode, city and country code.

- In the XML file: TRACONCE1

- Country(ies) of routing codes – Chronological order of all countries between departure and final destination. E.g. DE->FR->GB. The 2 digit country code must be used. This information can only be added on header level.

- In the XML file: CouOfRouCodITI1

- Mode of transport at the border – The mode of transport corresponding to the active means of transport in which the goods are expected to enter the customs territory of the Community. These are the options:

- Maritime

- Rail

- Road

- RoRo – accompanied

- RoRo – unaccompanied

- In the XML file: TraModAtBorHEA76

- Identity of means of transport crossing border – This field where appropriate contains the identity of the means of transport or, if containerised, the equipment identification number.

- For maritime, the IMO ship identification number to be included.

- For Rail the wagon number to be included.

- Not to be used for Air - the IATA flight number should be included in the data field ‘conveyance reference number’.

- For accompanied roll-on roll-off, the Vehicle Registration Number to be included. - Road (Channel Tunnel), the Vehicle Registration Number to be included.

- For unaccompanied roll-on roll-off, the IMO ship identification number to be included.

- In the XML file: IdeOfMeaOfTraCroHEA85

- First place of arrival code – The customs office of first entry code needs to be sent. E.g.: GB000040

List of codes for all ports:

https://www.gov.uk/guidance/location-codes-for-ports-of-entry-in-great-britain

If the port is missing from the list above, the closest customs office code needs to be sent.- In the XML file: RefNumCUSOFFFENT731

- Date and time of arrival at first place of arrival in the Customs territory – Expected date and time of arrival. Format: YYYYMMDDHHMM

- In the XML file: ExpDatOfArrFIRENT733

- Place of loading – Place of Loading is used for the identification of the seaport, airport, freight terminal, rail station or other place at which the goods are loaded onto the means of transport being used for their carriage, including the country where it is located.

- For unaccompanied this will be the port of departure

- For accompanied this will be the freight terminal, warehouse or other place

- In the XML file: PlaLoaGOOITE334

- Place of unloading - Place of unloading is used for the identification of the seaport, airport, freight terminal, rail station or other place at which the goods are unloaded.

- For unaccompanied this will be the port of arrival

- For accompanied this will be the freight terminal, warehouse or other place

- In the XML file: PlaUnlGOOITE334

- Goods description – This is a plain language description precise enough for customs to be able to identify the goods without reference to other documents/materials.

You can find acceptable item description examples here:

https://taxation-customs.ec.europa.eu/system/files/2021-03/guidance_acceptable_goods_description_en.pdf- In the XML file: GooDesGDS23

- Types of packages – Type of package to be specified from a list of package types.

You can find the package codes here:

https://www.gov.uk/government/publications/uk-trade-tariff-kind-of-packages-codes/uk-trade-tariff-kind-of-packages-codes- In the XML file: KinOfPacGS23

- Number of packages – The number of packages based on number of packages which are packaged in such a way that they cannot be divided without undoing the package.

- In the XML file: NumOfPacGS24

- Goods item number – The number of the item in relation to the total number of items contained in the declaration.

- In the XML file: IteNumGDS7

- Gross mass (kg) – Total Gross Weight of goods including packaging.

- In the XML file: TotGroMasHEA307

- Seal number – Seal number for package. If there is no seal, send ’No Seal’.

- In the XML file: SeaIdSEAID530

- Transport document number - The reference for the transport document that covers the transport of the goods into the UK. Usually Bill of Lading, Container List or the Commercial Invoice.

- In the XML file: DocRefDC23

- Transport Charges Method of payment code – The payment method for transport charges.

The codes are:

A - Payment in cash

B - Payment by credit card

C - Payment by cheque

D -Other (for example direct debit to cash account)

H - Electronic credit transfer

Y - Account holder with carrier

Z - Not pre-paid

a. In the XML file: TraChaMetOfPayHEA1 - Declaration date and time – The date and time when the declaration is submitted. Format: YYYYMMDDHHMM

- In the XML file: DecDatTimHEA114

Conditional Fields

- Unique Consignment Reference Number - This field must be provided by Fast Parcel Operators. It is optional for other modes of transport.

- In the XML file: ComRefNumHEA

- Carrier (or in other words, the haulier)- The person responsible for submitting the ENS.

- This field must be completed if the carrier is different from the person

lodging the ENS.

- This field must be completed if the carrier is different from the person

- The carrier must be identified by an EORI number and the carrier name and address are conditional.

- The name and address are optional if the EORI is a GB EORI.

- The name and address are mandatory if the EORI is an EU EORI.

- In the XML file: TRACARENT601

- Notify party - The party that needs to be notified of the arrival of the goods.

- This field must be provided where this information is available.

- In the XML file: NOTPAR670

- Conveyance reference number - This field should be provided for all modes except accompanied or unaccompanied roll on roll off. You should provide information to identify the journey of the means of transport for example, voyage, flight or trip number, if applicable.

- In the XML file: ConRefNumHEA

- Number of pieces - This field must be provided if pieces are unpackaged. if ‘type of package’ indicates bulk, number of pieces is not required.

- In the XML file: NumOfPieGS25

- Container number - This field must be provided where containers are being moved. In particular this must be provided for Maritime Containers and Unaccompanied RoRo (where it should be the Trailer Number).

- In the XML file: ConNumNR21

- Shipping marks and numbers of packages - This field must be completed for all packaged goods and should include information and descriptions that will enable the identification of individual packages.

- In the XML file: MarNumOfPacGSL21

- UN dangerous goods code - This code is a unique, 4-digit serial number assigned by the UN. It must be provided where relevant.

- In the XML file: UNDanGooCodGDI1

Optional Fields

- Commodity code - The commodity / HS code of the item. Only the first 4 digits are required.

- In the XML file: ComNomCMD1

- Total number of packages - The total number of packages for goods declared within declaration.

- In the XML file: TotNumOfPacHEA306

- Number of items - Total number of items declared in the Entry Summary Declaration.

- In the XML file: TotNumOfIteHEA305

- Other specific circumstances indicator - Specific circumstance indicator, can be:

A - Postal and express consignments

C - Road mode of transport

D - Rail mode of transport

E - Authorised economic operator- In the XML file: SpeCirIndHEA1

- Special mentions - Enter Codes for Special Mentions ‘Additional Information/Special Indication Code’ to be sent across the Common Domain.

The codes can be found under the 'Additional Information' tab in the Reduced ENS Dataset Excel file.- In the XML file: AddInfCodMT23

- Signature and authentication - I have not found anything related to this optional field. It does not seem to have a field in the XML.

- Declaration place - Text describing where the declaration was completed (office address etc).

- In the XML file: DecPlaHEA394

- Nationality of active means of transport crossing the border - Nationality of the Means of Transport Crossing Border (e.g.: trailer or unit ID). Should only be added for RoRo or Road movements.

- In the XML file: NatIDEMEATRAGI973

- Office of subsequent entry - Reference number is required if some of the goods are destined to be transported to subsequent Offices of Entry.

- In the XML file: RefNumSUBENR909

Sources

The newest Appendix 1 (which contains all the field rules and codes) can be downloaded from here: https://www.gov.uk/guidance/safety-and-security-requirements-on-imports-and-exports

The API guide can be accessed here: https://developer.service.hmrc.gov.uk/guides/safety-and-security-import-declarations-end-to-end-service-guide/

Still have questions about this? Let me know in the comments section!