Does HMRC allow multiple consignments for GB ENS?

HMRC allows multiple consignments in a GB ENS, but all must share the same routing codes. Otherwise, separate declarations are needed.

Before we dive in, let’s clarify what we mean by multiple consignments (or groupage).

A single transport unit—like a truck, container, or trailer—carrying goods from different sellers/exporters to different buyers/importers. That’s a multiple consignment. Even though the goods are traveling together in the same vehicle, each shipment is treated as a separate consignment because they belong to different trading parties.

HMRC does allow multiple consignments in a Safety and Security GB declaration. But there is a catch: all the consignments must have the same country of routing codes.

According to the documentation, the country of routing is:

The countries through which the goods are routed between the country of original departure and the final destination. The countries must be entered in the appropriate country code format.

The country of routing codes can only be provided at the header level in a GB ENS declaration. This means that if the consignments in a transport unit have different routing codes, you’ll need to create separate declarations for each routing group.

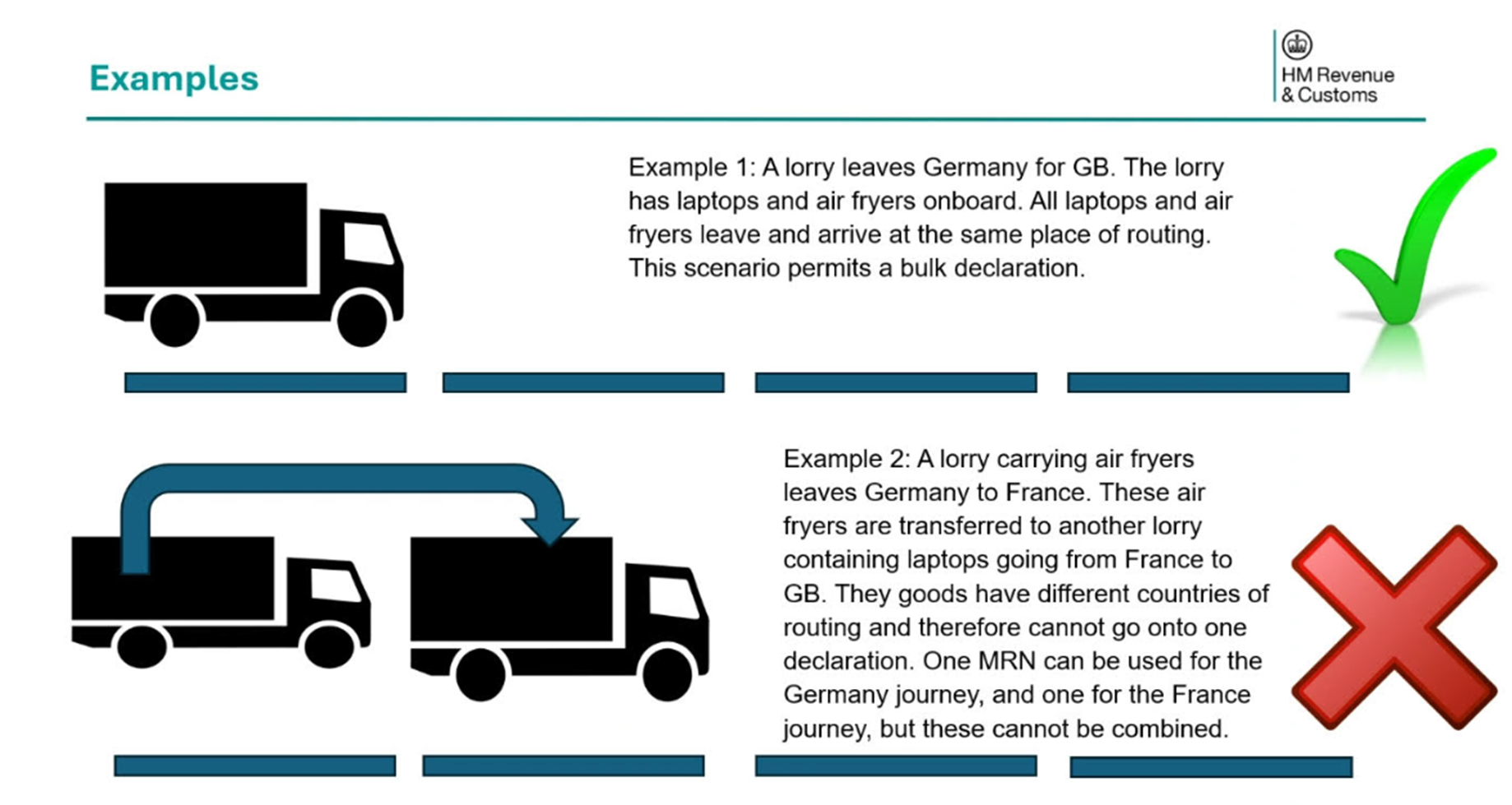

To make this clearer, here are a few examples from HMRC:

Examples for multiple consignments for GB ENS

Another important point to remember when dealing with multiple consignments is the 999-item limit per declaration, not per consignment. While HMRC doesn’t have a limit on the number of consignments in a single GB ENS, the 999-item cap for the entire declaration will limit how many consignments can be included.

If you still have questions about multiple consignments, feel free to ask in the comment section.